If your clients only have 30 seconds – key points:

- Strategic use of debt can amplify investment returns, as proven by the strong performance of the recommended JPY positive carry margin strategy last year.

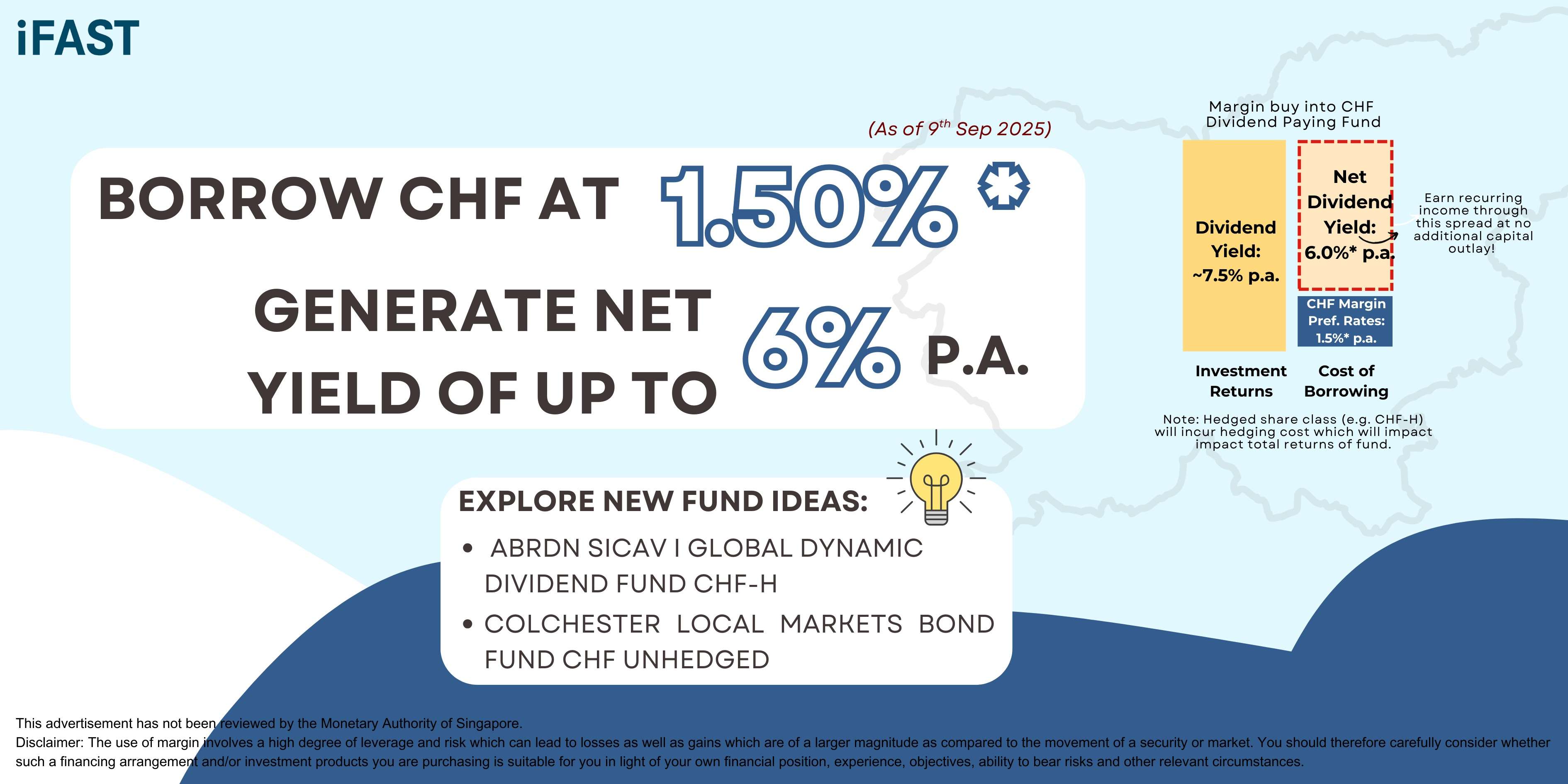

- The Swiss Franc (CHF) borrowing rate remains highly attractive at 1.50% p.a., enabling positive carry into higher-yielding dividend paying funds in CHF currency (~7.5% p.a)

- Investors who may be concerned about hedging cost in fixed income funds (CHF-hedged share class) may instead consider a global equity fund in CHF-hedged class, given that returns for equities have generally outpaced fixed income - Abrdn SICAV I Global Dynamic Dividend A CHF-H

- Alternatively, borrowing in an unhedged CHF share class could allow investors to benefit from potential currency weakening, as CHF is currently trading at multi-year highs with an opportunity for mean reversion to occur.

- Colchester Local Markets Bond Fund CHF Unhedged combines real-yield investing in emerging market government bonds with active FX management to deliver strong performance amongst its peers.

Strategic Use of Debt

It is common for high-net-worth individuals to use debt strategically rather than out of necessity. Like how a corporate leverages (i.e. take on debt) their balance sheets to drive growth, incorporating debt into their personal balance sheet can be an efficient way to preserve liquidity while amplifying investment returns.

Case in point: iFAST Margin clients who have followed our JPY positive carry recommendation last year to borrow JPY and invest into Amova Japan Dividend Equity JPY (formerly NikkoAM) have reaped both strong capital appreciation (comparing the fund’s NAV of 134.5 on 16 Apr 2024, the article’s publication date, with its recent NAV of 143.6 as of 2 Sep 2025) and positive net dividend returns (dividend yield less cost of JPY borrowing). It is noteworthy to highlight that these positive carry returns were generated without any additional capital outlay, since iFAST Margin clients can pledge their existing investment portfolio to borrow and invest immediately.

In essence, a Positive Carry Trade is a margin strategy that enables investors to borrow funds at a lower interest rate (e.g., 2.20% p.a.) and invest them in an income-generating asset with a higher return (e.g., 6.45% p.a.). The potential profit arises from the difference between the borrowing cost and the investment return (e.g., 4.25%), as illustrated below.

In May 2025, Swiss Franc (CHF) was added as the latest margin currency offering to FSMOne Margin due to its low borrowing cost, where Swiss National Bank reduced its policy rate to zero in June 2025 and has not ruled out the possibility of returning the policy rate back to negative territory (last seen in 2022), due to its continued low inflationary pressures in Switzerland.

Previously, fixed income ideas were shared on how to generate positive carry income through borrowing CHF at 1.50% (as of 4 Sep 2025) and investing into CHF-denominated dividend paying funds (5% to 8% yield). However, fixed income returns may also be impacted by hedging costs (particular for CHF-hedged share classes), thereby reducing the total returns for investors. If this is the case, investors may consider an equity-focused fund since returns for equities have generally outpaced fixed income, albeit with higher volatility.

Global Equity Fund – CHF Hedged

Investors may consider Abrdn SICAV I Global Dynamic Dividend A CHF-H based on the following:

- Balanced approached - 60% value and 40% growth stocks with a good mixture of value stocks (high dividend) and growth stocks (low dividend)

- Well-diversified equity portfolio across countries (U.S, France, United Kingdom etc.) and sectors (I.T., Financials, Industrials, & Healthcare)

- Dividend-capture strategy – tactical allocation into dividend events on high rotation basis to capture dividend events and generate yield for the fund.

- Annualised returns of 9.09% for the past 3 years for USD share class (as of 31 Jul 2025)

Note that this is a hedged CHF share class fund, which helps investors minimise foreign exchange risk. However, the trade-off is the hedging cost, which directly impacts the NAV of the CHF-hedged share class funds. Nevertheless, this is a good alternative for investors who wish for an equity exposure amongst all the CHF-fixed income funds.

|

Fund Name |

Indicative Dividend Yield* (as of 4 Sep) |

CHF borrowing cost (as of 4 Sep) |

Net Dividend Yield |

|

Abrdn SICAV I Global Dynamic Dividend A CHF-H |

5.80% |

1.50% |

4.30% |

*Dividend yield is indicative and obtained by multiplying the most recent dividend paid before the current month and the dividend frequency, divided by the NAV at the end of the preceding month. As dividends are not guaranteed and prices fluctuate, the indicated dividend yield is not representative of future dividend yields.

Is Now the Time to Go Unhedged?

To avoid hedging costs, investors may also consider borrowing in an unhedged share class if they are comfortable to take on the currency (FX) risk. Unhedged exposure is a double-edged sword which can work for or against the investor. If the borrowing currency strengthens (e.g. CHF) against the base currency (e.g. USD), the loan becomes more expensive as you will need more USD to repay the CHF loan. However, with the Swiss Franc (CHF) currently at multi-year highs, there is an opportunity for mean reversion where CHF may weaken in the medium to long-term, capturing additional FX gains for investor. An unhedged CHF share class fund allows investors to capture this opportunity.

Unhedged CHF Fixed Income Fund with Active FX Management

Introducing Colchester Local Markets Bond Fund CHF Unhedged (Accredited Investors only) with a distinct investment philosophy for targeting real yield and real exchange rate. The strategy to target real yield i.e. nominal yield minus inflation forecast provides a better inflation-adjusted returns. For example, if the stated nominal yield of bond coupon is 5% and inflation runs at 3%, the bond will only generate a real yield of 2%. Therefore, by prioritising bonds that can generate positive returns above inflation, Colchester can focus on delivering consistent value over time

Secondly, Colchester separates bonds returns from currency returns. Unlike traditional emerging market funds where currency performance is largely driven by underlying bond holdings (or in the case of hedged share class funds that apply a blanket hedge on currencies), Colchester actively manages FX exposure by overweighting undervalued currencies (e.g. KRW, EGP, CNY) or underweighting overvalued currencies (e.g. RSD, CZK) to enhance overall fund returns.

The bond portfolio is primarily invested in physical government (sovereign) bonds of emerging markets and FX instruments, with no exposure to corporate EM bonds or frontier markets. This approach has contributed to registering zero defaults since its entire fund history stretching back to January 2009. The fund has a 9.53% yield to maturity and average coupon of 8.3% (as of 31 July 2025)

In terms of performance, the fund has also consistently outperformed its peers, contributed by its focus on real exchange rates strategy, where it targets to generate one-third of its returns through active FX management (comparison of USD unhedged share classes):

|

Fund |

Portfolio Characteristics (as of 31 July 2025) |

Annulised

Performance |

|

Colchester Local Markets Bond Fund USD |

Yield to Maturity: 9.53% Avg. Duration: 5.79 years Avg. Credit Rating: BBB |

3Y: 9.72% 5Y: 2.58% |

|

Neuberger Berman Emerging Market Debt – Local Currency Fund USD |

Yield to Maturity: 8.99% Avg. Duration: 6.61years |

3Y: 7.08% 5Y: -0.09% |

|

Blackrock BGF Emerging Markets Local Currency Bond Fund A6 USD |

Yield to Maturity: 8.97% Avg. Duration: 6.05 years Avg. Credit Rating: BBB |

3Y: 8.13% 5Y: 1.68% |

|

JPMorgan Funds – Emerging Markets Local Currency Debt Fund USD |

Yield to Maturity: 8.30% Avg. Duration: 6.8 years Avg. Credit Rating: BBB |

3Y: 7.5% 5Y: 1.80% |

The CHF unhedged share class is designed specifically for investors looking to turn CHF’s low funding cost into an advantage:

- Positive Carry Advantage – With CHF margin rates at around 1.5% and coupon yields well above 7.5%, the potential net dividend spread (>6%) is highly attractive.

- Potential Currency Upside – The unhedged structure allows investors to benefit from potential appreciation in undervalued EM currencies, adding another layer of return.

- Regular Distributions – This class pays out quarterly dividends, creating a steady income stream. While IFAST Margin facility does not require any fixed repayment obligations, investors can use these dividends towards loan repayment on a quarterly basis.

Fund Switching – Impact to Loan

If your client previously invested in a CHF-denominated fund using the CHF margin payment method, switching funds will not affect their existing loan currency. They will continue to enjoy the same CHF borrowing rate of 1.50%, while simply switching into a different investment fund.

What should your clients know about the Key Risks?

1) Market Risk

Even in the absence of capital appreciation (i.e., a flat market), this carries trade strategy may still generate returns through the dividend spread of approximately 6.0% p.a. (indicative only, 7.5% – 1.5%). However, adverse market performance poses a significant risk, particularly in terms of margin calls.

Excessive leveraging poses a significant risk that should be avoided at all times. It is advisable to ensure that the margin ratio does not exceed 65% when placing any transaction. This provides a minimum level of safety buffer to cushion against any market decline, although additional buffer should be considered if the portfolio comprises riskier assets.

While fixed income carry trades (borrowing CHF at 1.50% and investing into CHF-denominated dividend-paying funds with yields of 5%–8%) can provide positive income, returns may be eroded by hedging costs (especially for CHF-hedged share classes). In such cases, investors may consider equity-focused funds, which historically offer higher returns compared to fixed income but come with greater volatility.

2) Interest Rate Risk

Switzerland’s inflation was just 0.3% year-on-year in March 2025, and the Swiss National Bank reduced its policy rate to zero in June 2025. These factors increase the probability of further monetary easing, which could reduce borrowing costs. A lower CHF funding cost would benefit margin investors, though future interest rate movements remain uncertain and could affect borrowing economics.

3) Currency Risk

If both the borrowing and investment currency are the same (e.g., CHF loans invested in CHF-denominated products), no cross-currency risk arises. However, CHF-hedged share classes (e.g., abrdn SICAV I Global Dynamic Dividend A CHF-H) carry hedging costs. These costs help manage FX volatility but reduce the net asset value (NAV) and overall return.

Alternatively, investors who are comfortable with foreign exchange exposure and expect medium- to long-term CHF weakness may opt for unhedged share classes (e.g., Colchester Local Markets Bond Fund CHF Unhedged). This approach introduces FX risk but provides the potential for additional gains if the CHF depreciates.

Interested in enrolling for iFAST Margin but not sure where to begin? Simply log in to iFAST App > Holdings > Margin Facility Enrolment > Opt in. Enjoy preferential CHF margin rate of just 1.50%, exclusively available to Accredited Investors who have completed a one-off product financing linkage (no minimum loan amount required).

Disclaimer:

The use of margin involves a high degree of leverage and risk which can lead to

losses as well as gains which are of a larger magnitude as compared to the

movement of a security or market. You should therefore carefully consider

whether such a financing arrangement and/or investment products you are

purchasing is suitable for you in light of your own financial position,

experience, objectives, ability to bear risks and other relevant circumstances.

Investment products involves risk,

including the possible loss of the principal amount invested. Past performance

is not indicative of future performance and yields may not be

guaranteed. All materials and contents found in this advertisement are strictly

for information purposes only and should not be considered as an offer or

solicitation to deal in any capital market products. You should consider

carefully if the investment products you are purchasing are suitable for your

investment objective, experience, risk tolerance and other personal

circumstances. If you are uncertain about the suitability of the investment

product, please seek advice from a financial adviser, before making a decision

to purchase the investment products.

While iFAST and/or any of its

third-party providers has/have tried to provide accurate and timely

information, there may be inadvertent omissions, inaccuracies, and

typographical errors. Opinions expressed herein are subjected to change without

notice.

This advertisement has not been

reviewed by the Monetary Authority of Singapore.

All materials and contents found in this Site/document are strictly for information purposes only and should not be considered as an offer, or solicitation, to deal in any of the Securities found in this Site/document. While iFAST Financial Pte Ltd ("IFPL") has tried to provide accurate and timely information, there may be inadvertent delays, omissions, technical or factual inaccuracies and typographical errors. Any opinion or estimate contained in this Site/document is made on a general basis and neither IFPL nor any of its servants or agents have given any consideration to nor have they or any of them made any investigation of the investment objective, financial situation or particular need of any user or reader, any specific person or group of persons. You should consider carefully if the products you are going to purchase into are suitable for your investment objective, investment experience, risk tolerance and other personal circumstances. If you are uncertain about the suitability of the investment product, please seek advice from a financial adviser, before making a decision to purchase the investment product. Past performance is not indicative of future performance. The value of the Securities and the income from them (if any) may fall as well as rise. Opinions expressed herein are subject to change without notice. Please read our full disclaimer in the website.

Share Article